- FAQ

Our Company will issue a crossed cheque and deposit directly to the client’s designated bank accounts when we receive the withdrawal instruction from the client.

Important Notice:

- Saturdays, Sundays and public holidays are non-working days; therefore, the fund withdrawal will be delayed.

- Bank account name must match with the name of the Client and for fund deposit only. Fund cannot be withdrawn to a third-person bank account.

- Clients can check the available balance in their personal accounts to confirm the withdrawal amount.

- Clients should give their withdrawal instructions before the daily cut-off time (Trading day from Monday – Friday, on or before 12:00pm). All late withdrawal instructions will be handled the next working day

- Account limit: the customer cannot use the sub-account for other bank services except fund deposit for securities activities.

- Deposit methods: Customers can deposit through online transfers or going to the bank counters directly. However, it does not support automatic teller machines (ATM) service. Please refer to the following data:

Cash Deposit Machine

Phone banking

For enquiries and application, please contact your customer service officer.

Stock In:Deposit the stock to the client account of Golden Rich Securities Limited

Stock Out:Withdraw the stock from the client account of Golden Rich Securities Limited

Client should fill all the brokers’ information in the form.

Information provided ﹕

|

Company Name |

Participant ID |

Contact Person |

Contact No. |

|

Golden Rich Securities Limited |

B02009 |

Settlement Department |

(852)2377-6893 |

(1) Stock transfer is only allowed under the account with same name among different securities brokers.

(2)Generally, there will be fees charged for stock withdrawal and stock deposit is free of charge. Client should confirm with the brokers from which the stock is withdrawn for the fees charged.

Stock In

Client can deposit non-physical stock through CCASS by Settlement Instruction (SI) and Investor Settlement Instruction (ISI). The counter party of the Settlement Instruction (SI) is either a bank or a stock broker; the counter party of the Investor Settlement Instruction (ISI) is the CCASS investor account of the client.

Client should fill and sign the Securities Settlement Instruction (SI) /Investor Settlement Instruction (ISI) Form. Our company does not charge on non-physical scrip deposit.

Our company will process the instruction on the same day if it is received before 2:00pm. Instruction received after 2:00pm will process on next working day. Our company will contact the counter party or client to verify and confirm the instruction. If our company fails to verify and confirm the instruction, the instruction will be delayed or cancelled.

Stock Out

Client can withdraw non-physical stock through CCASS by Settlement Instruction (SI) and Investor Settlement Instruction (ISI). The counter party of the Settlement Instruction (SI) is bank or broker; the counter party of the Investor Settlement Instruction (ISI) is the CCASS investor account of the client.

Client should fill and sign the Securities Settlement Instruction (SI) /Investor Settlement Instruction (ISI) Form. The handling charge for SI is HKD100 per stock plus 0.002% of the previous day closing market value of the stock, subject to a minimum fee of HKD3 and maximum of HKD200 per stock. The handling charge for ISI is HKD100 per stock.

Our company will process the instruction on that day if it is received before 2:00pm. Instruction received after 2:00pm will be processed on next working day. Our company will contact the counter party or client to verify and confirm the instruction. If our company is unable to verify and confirm the instruction, the instruction will be delayed or cancelled.

Stock Deposit

Client is required to deposit the physical scrip, which is signed by the transferor on the Form of Transfer, at CASH’S sales & operation Centers. A receipt will be issued immediately for the scrip deposit. Our company does not charge on physical scrip deposit, but Hong Kong Government will charge HKD 5.00 per scrip or transfer form (in name of client) for physical scrip deposit. Deposit via post or mail by client is not accepted due to security issue.

A mandatory 10 working days period is required (starting from the day of stock deposit to HKSCC) before a client can withdraw funds from the sale of deposited securities. Exceptional cases may be considered on an individual basis.

Stock Withdrawal

Client can fill and sign the Physical Scrip Withdrawal / Stock Internal Transfer Form to withdraw physical scrip. Stock code, stock name, denomination and quantity should be stated clearly. Online client can also submit the physical scrip withdrawal instruction through Internet.

Handling charge for physical scrip withdrawal is HKD 5.00 per lot (minimum charge HKD 50 per stock). The process will be completed within 7 working days. Our company will notify client to collect the stock via phone/email.

Client may fill and sign Authorization Letter For Collecting Physical Scrip to authorize a third party to collect the physical scrip. This third party must collect the stock with the original authorization letter. The authorization letter must include the third party’s name, ID number, stock code, stock name, and number of shares for verification.

Client must self-collect or authorize the third party to collect the physical scrip at instructed place within one month. If client cannot pick up the physical scrip in a particular period, our company will re-deposit the scrip into CCASS. Handling fee will be charged again when the client makes another physical scrip withdrawal instruction for the re-deposited stock.

Stock Renouncing

If client hold stock that is minimal in market value or difficult to sell in the market, client can fill and sign the Renouncing Share Form to renounce all the title, interest and benefit for the share and unconditionally assign to our company to deal with the renounced share.

During the Pre-opening Session, the system accepts at-auction and at-auction limit orders only.

The Pre-opening Session consists of an order input period, a pre-order matching period, an order matching period and a blocking period as follows:

|

Pre-opening Session |

Time |

Remarks |

|

order input period |

From 9:00 a.m. to 9:15 a.m. |

During the order input period, only at-auction orders and at-auction limit orders are accepted. Orders are accumulated and updated in AMS/3 continuously and may be modified or cancelled. |

|

pre-order matching period |

From 9:15 a.m. to 9:20 a.m. |

During the pre-order matching period, only at-auction orders are accepted and modification or cancellation of orders in AMS/3 will not take place. |

|

order matching period |

From 9:20 a.m. to 9:28 a.m. |

Orders will be matched in order type (at-auction order first), price and time priority at the final IEP. |

|

blocking period |

From 9:28 a.m. to 9:30 a.m. |

During the blocking period, no terminal activities are allowed. |

- At-auction Order

An at-auction order is an order with no specified price and is entered into the AMS/3 for execution at the final Indicative Equilibrium Price (IEP). It enjoys a higher order matching priority than an at-auction limit order and will be matched in time priority at the final IEP.

Any outstanding at-auction orders after the end of the Pre-opening Session will be cancelled before the commencement of the Continuous Trading Session.

- At-auction Limit Order

An at-auction limit order is an order with a specified price. An at-auction limit order with a specified price at or more competitive than the final IEP (in case of buying, the specified price is equal to or higher than the final IEP, or in case of selling, the specified price is equal to or lower than the final IEP) may be matched at the final IEP subject to availability of eligible matching order on the opposite side. An at-auction limit order will be matched in price and time priority at the final IEP. No at-auction limit order will be matched at a price worse than the final IEP.

Any outstanding at-auction limit orders at the end of the Pre-opening Session will be carried forward to the Continuous Trading Session and treated as limit orders provided that the specified price of that at-auction limit order does not deviate 9 times or more from the nominal price. Such orders will be put in the price queue of the input price.

A warrant is a derivative. It gives the buyer the right to buy or sell the underlying asset at a set price within a certain time. The underlying asset can be stock, market index, currency or commodity.

What Are Derivative Warrants?

Derivative warrants are instruments that give an investor the right to "buy" or "sell" an underlying asset at a pre-set price prior to a specified expiry date. They may be bought and sold prior to their expiry in the market provided by HKEx. At expiry, settlement is usually made in cash rather than a purchase or sale of the underlying asset. Derivative warrants can be issued over a range of assets, including stocks, stock indices, currencies, commodities, or a basket of securities. They are issued by a third party, usually an investment bank, independent of the issuer of the underlying assets. Derivative warrants traded in Hong Kong normally have an initial life of six months to two years and when trading in the market each derivative warrant is likely to have a unique expiry date.

Types of Derivative Warrants

Derivative warrants are generally divided into two types: calls and puts. Holders of call warrants have the right, but not obligation, to purchase from the issuer a given amount of the underlying asset at a predetermined price (also known as the exercise price) within a certain time period. Conversely, holders of put warrants have the right, but not obligation, to sell to the issuer a given amount of the underlying asset at a predetermined price within a certain time period. Derivative warrants are "exercised" when holders use their rights to purchase or sell the underlying assets. As mentioned, in Hong Kong derivative warrants are usually settled in cash when they are exercisedat expiry. In fact most derivative warrants are sold by their owners on the Exchange prior to their expiry dates.

Derivative warrants may be issued in American or European styles. Holders of American-style derivative warrants may exercise at any time prior to expiry while holders of European-style derivative warrants may only exercise on the expiry date. Currently derivative warrants listed on the Exchange are mostly European-style warrants.

How Do Derivative Warrants Work ?

Those who buy call warrants usually hold a bullish view of the price of the underlying asset. To profit from the purchase of a call warrant the holder of the warrant may sell the warrant in the market or wait until the expiry date. At the expiry of a call warrant, if the price of the underlying asset as calculated under the terms of the derivative warrant is higher than the derivative warrant's exercise price, the call warrant will be exercised and the holder will be entitled to the difference in cash, assuming the derivative warrant is cash settled. The cash amount will be equal to the positive difference between the closing price of the underlying asset and the exercise price of the derivative warrants adjusted by the entitlement ratio. The closing price of the underlying asset is calculated by a formula described under the "Settlement Price" section below. If the price of the underlying asset at expiry is less than the exercise price, the derivative warrant will expire worthless.

Conversely, those who buy put warrants usually hold a bearish view of the price of the underlying asset. Like the call warrant, the holder can sell the put warrant in the market or wait until expiry. At the expiry of a put warrant, if the price of the underlying asset as calculated under the terms of the derivative warrant is lower than the derivative warrant's exercise price, the put warrant will be exercised and the holder will be entitled to the difference in cash, assuming the derivative warrant is cash settled. The cash amount will be equal to the positive difference between the exercise price of the derivative warrant and the dosing price of the underlying asset adjusted by the entitlement ratio. If the price of the underlying asset at expiry is higher than the exercise price the derivative warrant will expire worthless.

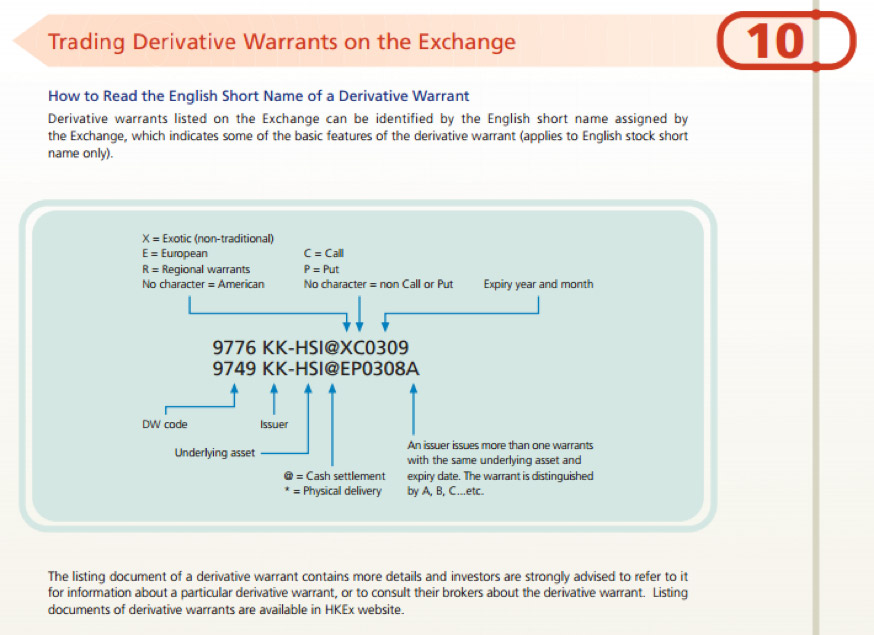

How can an investor get quick information from the English short name of a derivative warrant?

In general, the English short name indicates some of the basic features of the derivative warrant:

Example: KK-HSI@EP0608A![]()

- @: Cash Settlement; *: Physical Delivery

- X: Exotic Warrant; E: European; R: Regional Warrants; Space: American

- C: Call; P: Put; Space: Non Call/Put

- Applicable if an issuer issues more than one warrants with the same underlying asset and expiry date. The warrant is distinguished by A, B, C... etc.

Trading Arrangement

Derivative warrants are traded on the Exchange during trading hours in board lot multiples settled on T+2 (T being the transaction day). Investors may contact their brokers for placing orders.

Similar to the stock trading arrangements, transaction fees include brokerage commission, transaction levy, trading fee and investor compensation levy (suspended since December 2005). In general, derivative warrants are cash settled and are not subject to stamp duty.

The expiry day of a derivative warrant is not the same as the last trading day. To ensure that a trade executed on the last trading day has sufficient time for settlement and any registration, there are three settlement days between the last trading day and the expiry day. Investors can only trade the derivative warrant on or before the last trading day. For example, if a derivative warrant expires on Friday, 23 June, the last day of trading will be Monday, 19 June (assuming all days from 19 to 23 June are settlement days).

Settlement Price

For derivative warrants issued on a single stock traded on the Stock Exchange, the settlement price is calculated based on the 5-day average closing price of the underlying stock prior to and excluding the expiry day.

For index warrants, the settlement price is usually based on the final settlement price of the corresponding index futures contract of the same expiry month traded on the Futures Exchange.

Access to Derivative Warrant Information

HKEx website provides a vast amount of information on the derivative warrants traded on its securities market, including a full list of derivative warrants listed on the Exchange and their Liquidity Providers, listing documents, announcements, Liquidity Provider information, investor education materials, etc. Investors can refer to the Derivative Warrant Resource Centre on HKEx website (www.hkex.com.hk) for more information.

GR Securities Trading App is using Hong Kong's most prestigious stock market information analysis platform and solutions provider. It is one of the most stable system on the market and the most comprehensive local securities trading app.

Feature 1: Most speedy and stable Quotation

- Free delay quotation (free offer upon opening securities account)

- Streaming instant quotation (For enquiry of discounted subscription fee please contact customer service)

Feature 2: Portfolio is obvious at a glance

- One click to BUY/SELL in my Portfolio

- Buying Power, Free Cash, Total Equities are obvious at a glance

- Multiple choices of trading type, the first to seize the opportunity

Feature 3: Most comprehensive and up-to-date market data

- Hong Kong, China, Worldwide Indices

- Instant financial news, included HK Top 20 and market abnormal news

- Dividend history, 52-week hign/low

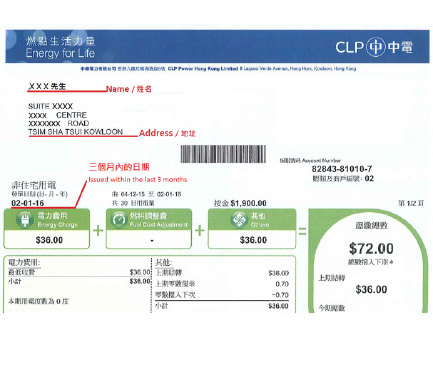

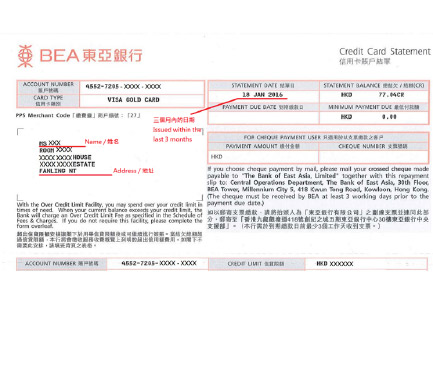

a. Government Rates demand note / Tax demand note issued within last 3 months

b. Utility bill issued within last 3 months

c. Statement or advice issued by other financial institutions, e.g. banks, credit card companies, insurance companies, MPF trustee companies within last 3 months

Trading units vary based upon each type of stock, with the smallest trading unit ranges from 50 shares to 100000 shares per stock. 「Board Lot」 and 「Block」 are terms for number of buy/sell shares. 「Board Lot」 refers to the basic number of shares for each transaction. The number of shares per Board Lot depends on each individual stock and is related to the stock price. Normally for stocks with high prices, the number of shares per Board Lot will be fewer. On the other hand, stocks with lower prices will have more shares per Board Lot.

If customers choose e-statement by email, the e-statement will be sent out by the trading day.

Also, customers can login to the online trading portal to check the daily and monthly statement.

Securities Settlement

All Exchange trades are required to be settled on T+2. SI transactions are settled on the settlement day stipulated by both participants. Securities settlement is effected either by scheduled daily batch settlement runs or immediately on-line by the input of Delivery Instructions (DIs). Provided that there are sufficient stocks in the stock account of the delivering participants, settlement of ISIs will be immediately effected on the settlement day specified by the brokers or custodians which are CCASS participants once the investor participants make the affirmation. Otherwise, the ISI transactions will be settled by multiple batch settlement-runs or the input of DIs.

Both methods enable CCASS to effect electronic book-entries to participants' stock accounts. During each batch settlement run, delivering participants' stock accounts are debited and the stock accounts of receiving participants' are credited; delivering participants may choose, or be requested by counterparties, to settle a position or transaction on-line by initiating DIs. Each DI takes immediate effect upon input, if there is sufficient stock balance available in the delivering participant's stock clearing account.

On-line enquiries on settled or unsettled positions are available to brokers and custodians which are CCASS participants through CCASS terminals and to investor participants via CCASS phone system or the internet to help them monitor their settlement activities.

Money Settlement

HKSCC provides money settlement services for all transactions settled on a Delivery Versus Payment(DVP) basis, where payment will follow delivery of securities in CCASS. Trades settled under CNS system are always on a DVP basis. For isolated trades, SI and ISI transactions, participants can choose to settle them on a DVP or Free of Payment (FOP) basis. For transactions settled on a FOP basis, participants make their money settlement outside CCASS without involving HKSCC. Participants can also elect to settle SI and ISI transactions on a Realtime Delivery Versus Payment (RDP) basis. Under RDP system, shares are delivered to the stock account of paying participant upon receipt of payment confirmation from Hong Kong Interbank Clearing Limited (HKICL).

Each participant establishes an account at a designated bank and authorises HKSCC to initiate electronic instructions to debit or credit its designated bank account. Book-entry money records are generated for a participant in its money ledger with respect to its settlement and other financial obligations due to or from HKSCC. Settlement is processed through the clearing system of HKICL against participants' designated bank accounts.

Brokers and custodians which are CCASS participants may enquire about their money obligations for settled or unsettled positions through their CCASS terminals throughout the settlement day. Investor participant can make enquiry of such information via CCASS phone system or the internet.

The money positions arising from Exchange trades settled under CNS system in each stock position are netted, resulting in a single net amount due to or from the participant. This is settled by direct debit or credit instruction issued by HKSCC to the designated bank of the participant no later than day-end of the settlement day.

HKSCC acts as a facilitator for isolated trades, SI and ISI transactions settled on a DVP and RDP basis, and issues electronic payment instructions to the designated banks of the participants concerned to effect money settlement.